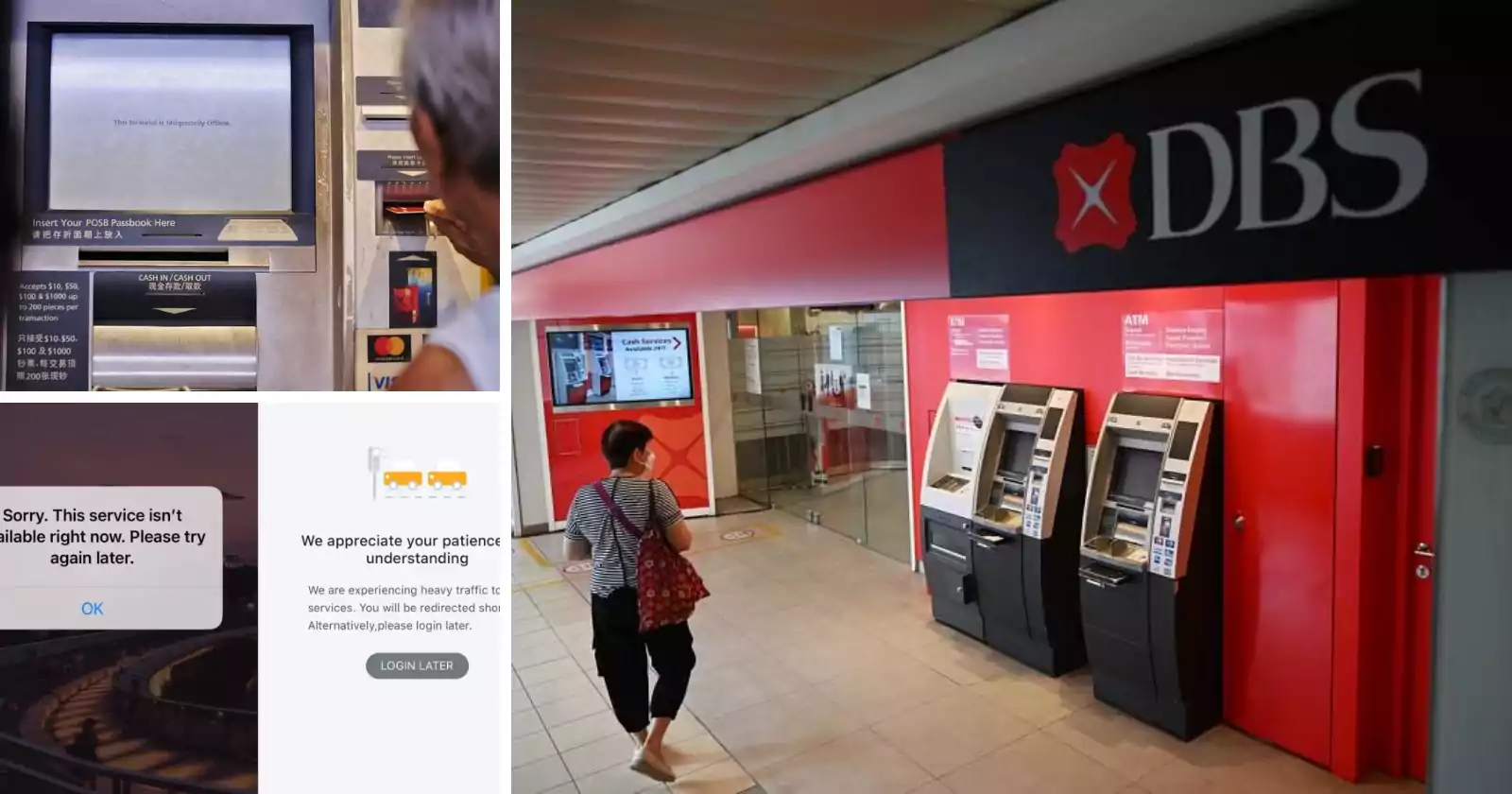

In an unexpected turn of events, DBS Bank customers found themselves unable to access the bank’s online and mobile services, as well as experiencing issues with their physical transaction cards on a Saturday afternoon. The Downdetector website, a platform that tracks service disruptions, recorded a significant surge in complaints about DBS starting around 2:30 p.m. By 4.08 p.m., a staggering 3,800 people had reported difficulties with DBS’s services.

Service Disruption Originates from Data Center Issue

In a Facebook update at 6.08 p.m. on the same day, DBS revealed that their investigations pinpointed the root cause of this disruption to an issue at a data center. Interestingly, this data center is shared with several other organizations, potentially indicating a widespread impact.

Disrupted Services Extend to Social Media and Citibank

The disruption didn’t spare other digital services either. Some netizens reported difficulties accessing Meta’s platforms such as Facebook, Instagram, and WhatsApp. Furthermore, Citibank’s services faced similar issues. The wide-reaching nature of this incident raised concerns among users.

DBS’s Restoration Efforts and Assurance

DBS has assured its customers that they are working diligently to restore services and expect a gradual return to normalcy starting at 7 p.m. To assist their customers, all DBS branches have been reactivated, except for those located at Tampines Central, Tampines One, and White Sands.

DBS emphasized that their systems remain uncompromised, ensuring that customers’ funds and deposits are secure. They expressed their gratitude for their customers’ patience during the service disruption.

User Frustrations and Outage Impact

The disruption prompted numerous customers to voice their frustrations on various online platforms. Users on HardwareZone forums and on DBS and POSB’s Facebook posts reported difficulties accessing the bank’s app and website, as well as using their cards for in-store payments.

Supermarket Chain FairPrice Also Affected

The impact of this disruption rippled beyond just banking. Supermarket chain FairPrice’s mobile application alerted its users that payment using DBS, POSB, and Citibank was temporarily unavailable, further complicating the situation for customers.

DBS’s History of Disruptions

This isn’t the first time DBS has faced digital service disruptions. Similar incidents occurred earlier this year, leading to regulatory action by the Monetary Authority of Singapore (MAS). The bank was subjected to additional capital requirements in response to these previous disruptions.

DBS CEO Piyush Gupta publicly apologized for the earlier disruptions, and a special board committee review was initiated as a priority. The bank aims to learn from past incidents and continue to improve its digital services to better serve its customers.

This recent incident serves as a reminder of the importance of a robust and resilient digital infrastructure, ensuring customers can access essential services without interruptions. As DBS endeavors to restore services gradually, users are encouraged to stay patient and vigilant during this process.

Leave a Reply