In a significant development, the rate of inflation in the UK dropped to its lowest point in nearly two and a half years last month. This decline was primarily driven by slower increases in the prices of food and dining out.

February witnessed a notable decrease in inflation, with the rate falling to 3.4% from the previous 4%, marking the slowest pace of cost-of-living growth since September 2021. The deceleration in price rises was particularly notable in food and non-alcoholic beverages, as well as in cafes and restaurant prices. Additionally, there were marginal decreases in alcohol, tobacco, clothing, and footwear prices. However, housing and fuel costs continued to rise at a rapid pace.

A significant contributor to the escalating housing costs was the substantial surge in average private property rents, which rose by 9% in the year leading up to February 2024, representing the largest annual percentage increase since records began in January 2015.

Despite this encouraging downward trend in inflation, prices have not yet begun to decrease; rather, they are rising at a slower rate than before. Grant Fitzner, chief economist at the ONS, highlighted this as the eleventh consecutive monthly decrease, indicating an ongoing downward trajectory.

Speculation regarding potential price impacts resulting from disruptions in the Red Sea did not materialize significantly. This was attributed to the strengthening of the sterling rate and the UK’s enhanced ability to pay for imports.

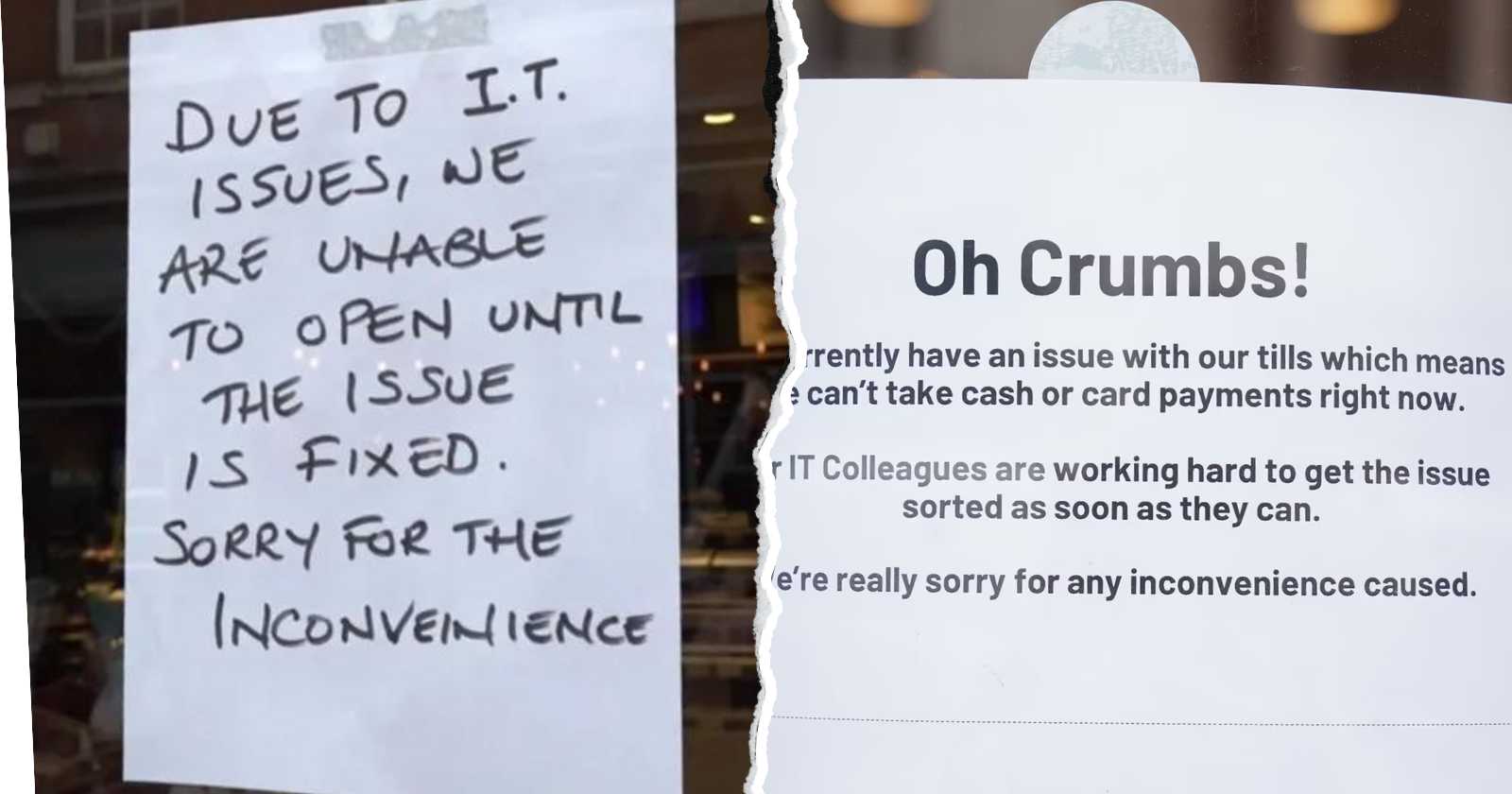

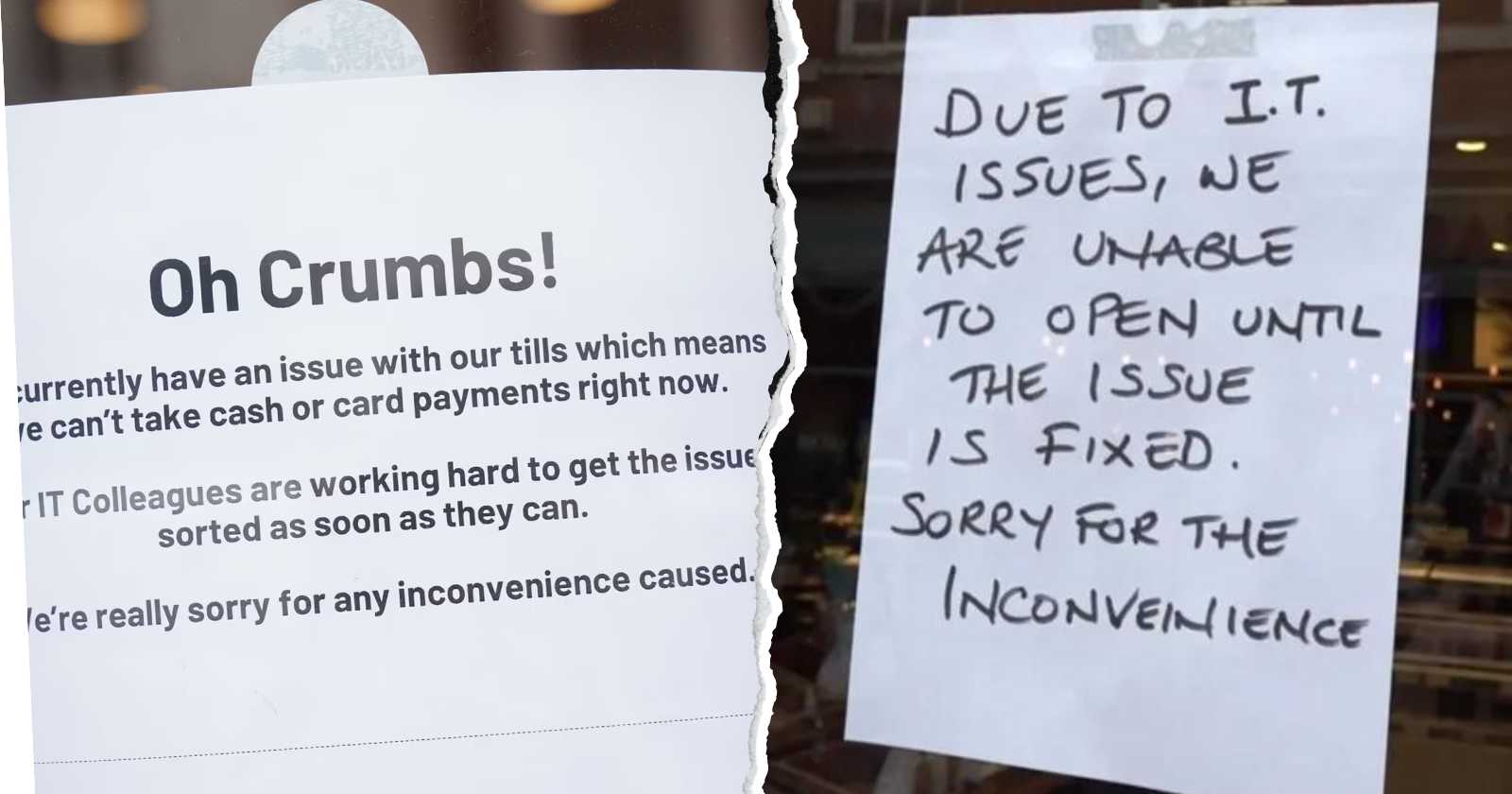

The effects of this inflationary trend were palpable on small businesses across the UK. Entrepreneurs like Fritz Ali Khan of Payal Events and Shaine Ashley Tench of A Star Taxis voiced concerns about rising costs affecting their operations. Khan highlighted increased staff wages and ingredient costs, while Tench lamented soaring insurance premiums, posing challenges to maintaining affordability for customers.

Looking ahead, the Bank of England’s upcoming interest rate decision is anticipated to maintain rates at 5.25%. Although a decrease in the energy price cap next month is expected to further drive down inflation, households may face above-inflation price hikes in various sectors like water rates, mobile phone and broadband services, and car insurance.

Chancellor Jeremy Hunt acknowledged the relief brought by the inflation figures but cautioned against premature conclusions regarding potential tax cuts. He emphasized the potential for the Bank of England to consider reducing interest rates as inflation approaches its target, thereby alleviating mortgage burdens.

However, the Labour Party criticized the Conservatives, asserting that after 14 years in power, working people continue to face financial challenges. Shadow Chancellor Rachel Reeves highlighted persistently high prices, escalating tax burdens, and increasing mortgage payments as key concerns.